Private Client Policies

Private Client Services

Free Quotes | Over 30 Years of Experience | Locations in FL and PA

Free QuotesOver 30 Years of ExperienceLocations in FL and PA

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Life Insurance, Estate Planning, and More

When it comes to managing and planning your wealth, RTI Insurance Services offers a variety of important plans. Our team of representatives is ready to help you look after your family's future.

Life Insurance

Life insurance is a crucial step in planning for your future and your family's future. It allows your promises and obligations to be fulfilled to your family if you are no longer living.

The death benefit is income-tax free¹

and can be used to cover funeral expenses, repay debt, provide education, pay estate taxes, and take care of any other expenses your survivors may incur.

Life insurance may also be used to help ensure that a family business will pass to the intended survivor. You also will receive benefits during your lifetime with certain types of life insurance plans.

¹

Internal Revenue Code § 101(a) (1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation.

Estate Planning

An estate plan is an integrated set of legal documents controlling what happens to you and your assets if you become incapacitated or if you die. If you don’t have a plan, the state in which you live has a plan set up for you. Our estate planning team will meet with you and help you create an integrated estate plan to care for yourself and your family with the minimum amount of delay, expenses, and taxes.

With guidance from an attorney whose practice has been especially dedicated for more than 30 years to estate and trust planning and administration, you will be able to protect your assets. You can rest assured your final wishes will be met. Our legal team is dedicated to estate planning and has been involved with the creation and/or administration of more than 3,000 estates/trusts across 5 states.

Our scope of services ranges from simple wills to complex estates comprised of multiple trusts and other legal entities to minimize taxes, provide a level of privacy and asset protection for families and their businesses.

Basic Documents

Basic documents in estate planning include the following:

- Will – a legal document that transfers assets in your name at the time of your death to your intended beneficiaries

- Durable power of attorney — a legal document naming a designated person(s) to make financial decisions on your behalf when you are not able

- Advance health care directive or durable power of attorney for health care — a legal document naming a designated person(s) to make all health care decisions for you when you are unable to do so for yourself, including terminal illness situations

Other Documentation

- Revocable and irrevocable trusts — Trusts can be revocable. That is, they can be changed by the person setting up the trust. Irrevocable is a term denoting the fact that the terms of the trust cannot be changed by anyone

- Asset protection — Asset protection is the use of legal documents that guard your assets/wealth from the claims of ex-spouses, creditors, and predators. This may involve creating limited liability companies and/or partnerships, corporations, and irrevocable trusts

- Business succession — Business succession is generally the process of establishing a plan backed up by legal documents to assist in the orderly and tax-efficient transfer of the ownership in a business to the next generation. We will discuss and explain the benefits of family limited partnerships, family limited liability companies, and buy-sell agreements funded utilizing life insurance to ensure a seamless transfer of ownership to your family

The best time to plan your estate is right now so you are prepared before you become incapacitated or die. The most important benefit is peace of mind, knowing your wishes will be fulfilled, your transfer taxes will be eliminated or minimized, and your family harmony preserved.

Wealth Transfer

Wealth transfer is a vital step in planning for your future and your family's future. It can fulfill promises and obligations to your family if you are no longer living.

The death benefit is income-tax free¹ and can be used to cover funeral expenses, repay debt, provide education, pay estate taxes, and take care of any other expenses your survivors may incur.

¹ Internal Revenue Code § 101(a) (1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation.

Risk Management — RiskPro365

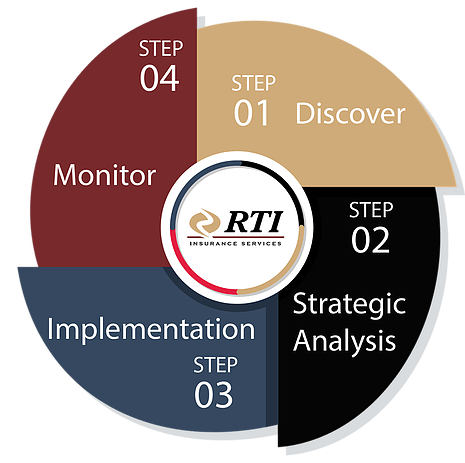

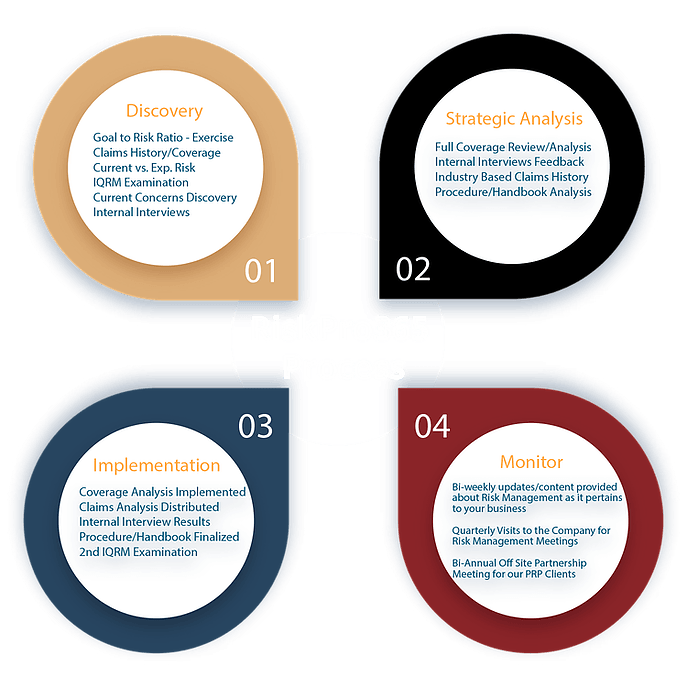

Our RiskPro Process operates on the simple principle that we believe our clients are truly better off with us than without us.

Our core service is a diagnostic and consultative approach for uncovering and mitigating risk for medium-size businesses and financially successful individuals and families.

We utilize a four-step process to identify, understand, implement and monitor risk management strategies.

Our consultative approach includes utilizing our proprietary risk mitigation tools to improve profitability and financial protection along with insurance 365 days a year.

Get Started With Us

We want to work with you to meet all of your insurance needs. Give one of our agents a call today to discuss a plan that's tailored to serve your unique needs.

1 (800) 373-0350

1 (800) 373-0350

VISIT US

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Hi. Do you need any help?

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

CONTACT US

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2024

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.

Share On: