Blog Layout

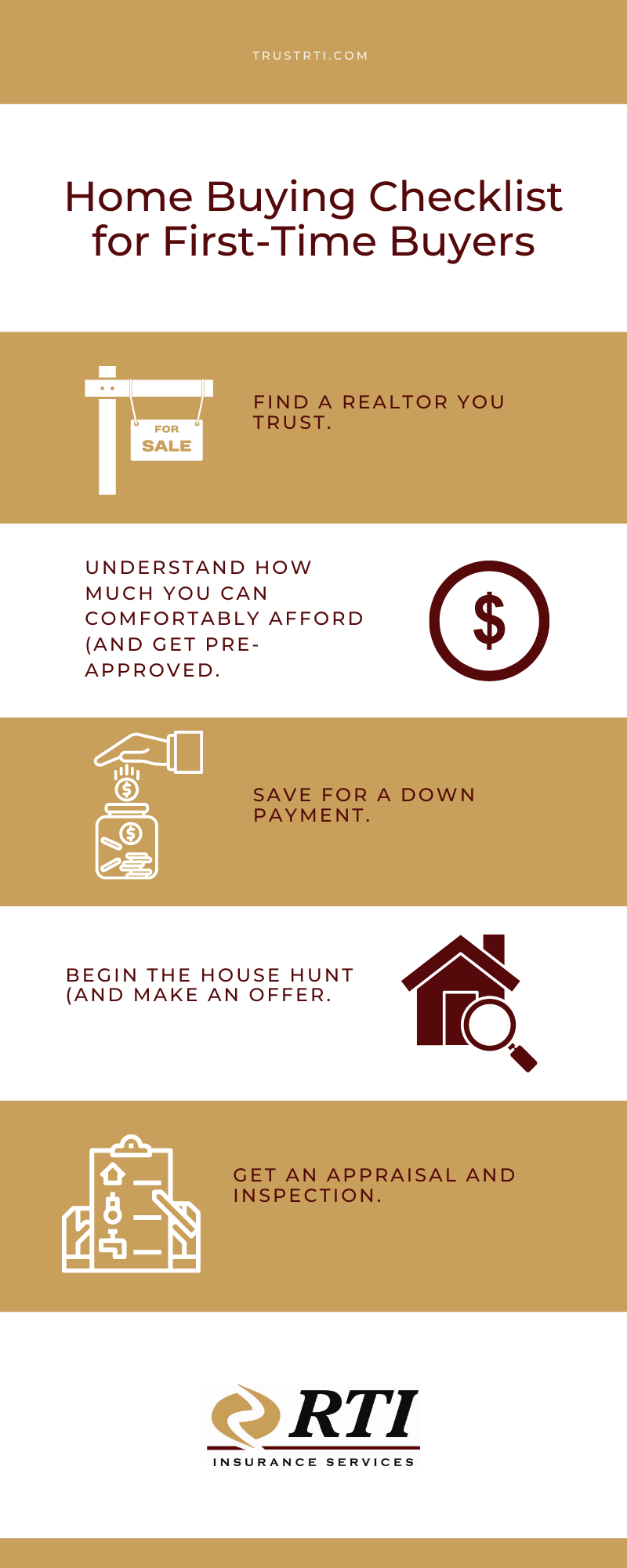

Home Buying Checklist for First-Time Buyers [Infographic]

Hibu Websites • May 14, 2021

Buying your first home is an equally exciting and intimidating decision. But beyond the thrill of looking at new homes and finding the one you’re willing to write an offer for, there are steps you’ll want to take to ensure you’re being thorough and attentive throughout the process.

In this blog post, we’re sharing five to-do’s during the home-buying process.

Find a realtor you trust

Working with a licensed real estate agent can make the entire home-buying process easier. That’s because real estate agents are trained professionals who have a deep understanding of the process from start-to-finish.

But, before choosing an agent, do your research.

Ask your family and friends who they’ve used in the past and about their experience. Or, head to Google and do some searches about local real estate agents and read about their accolades, online reviews, and check out their social presence to get a better idea of their capabilities.

Understand how much you can comfortably afford (and get pre-approved)

Understanding the range of your budget is an important step in the process. It essentially dictates the parameters you’ll provide your real estate agent when looking for homes.

If you’re not sure where to start, begin with calculating your debt-to-income (DTI) ratio. This will give you a better idea of your current financial situation.

From there, you’ll want to approach the bank of your choice to get a pre-approval for a mortgage. Now, this isn’t a guarantee you’ll get a loan for your mortgage. However, a pre-approval does mean a loan officer has reviewed your finances (assets, debt, credit history, and income) and determined how much money you can borrow from a bank, your monthly payment, and the interest rate.

Save for a down payment

If you’re unfamiliar, the down payment is a sizable, one-time payment that’s applied to the purchase of a new home. How much you put down depends on the type of mortgage you choose.

According to Rocket Mortgage, the average down payment is about 6% of the borrower’s loan value. However, a homebuyer can put as little as 3% down depending on the type of loan and the person’s credit score.

But, be aware even a smaller down payment can be a large sum of money. For instance, a 6% down payment on a $300,000 home is $18,000.

Consider speaking with a financial professional to create a savings plan to help you set and reach your down payment goal.

Begin the house hunt (and make an offer)

Now that you’ve selected a real estate agent you can trust, have an understanding of what you can comfortably afford, are pre-approved, and have money saved for a down payment, it’s time for the fun part...House hunting!

Before you begin your search, share a list of must haves with your real estate agent to give them a better idea of what you’re looking for. Some things to consider might be:

Price

Square footage

Commute to work

The overall condition of the house (is it turn-key or does it need updates?)

Giving your agent some criteria to work with will help them better understand what you’re looking for in a home.

Once you’ve found “the one,” it’s time to make an offer. This is typically the step where your real estate agent takes over. They’ll submit an official offer letter that includes some information about you and your situation.

There are some different strategies that can be applied at this point, however, that’s something you’ll want to discuss with your agent at the time.

After your offer is submitted the seller can either:

Accept the offer and you move onto the next step.

Reject the offer and it’s up to you and your agent to either move on to another home or resubmit another offer.

Counter your offer to which you can either accept, reject, or come up with a counteroffer of your own.

Get an appraisal and inspection

Once you and the seller have reached an agreement, it’s time to move on to the appraisal and inspection portion of the home-buying process.

A home appraisal provides the current value of the property you’re looking to purchase. This is a necessary step as an appraisal is needed for a mortgage loan.

A home inspection is also needed to gain a better understanding of the overall condition of the home and uncover major issues that could lead to a costly mistake if purchased.

And, before you close on your new house, it’s a good idea to start doing your research to find a homeowner’s insurance policy. If you have any questions when it comes to choosing the right coverage for your home, contact

one of our insurance experts today.

VISIT US

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Hi. Do you need any help?

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

CONTACT US

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2024

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.

Share On: